Fonds national juif du Canada

Le Fonds National Juif du Canada, avec le soutien des donateurs et bénévoles à travers le pays, prépare les fondations de l'Israël de demain.

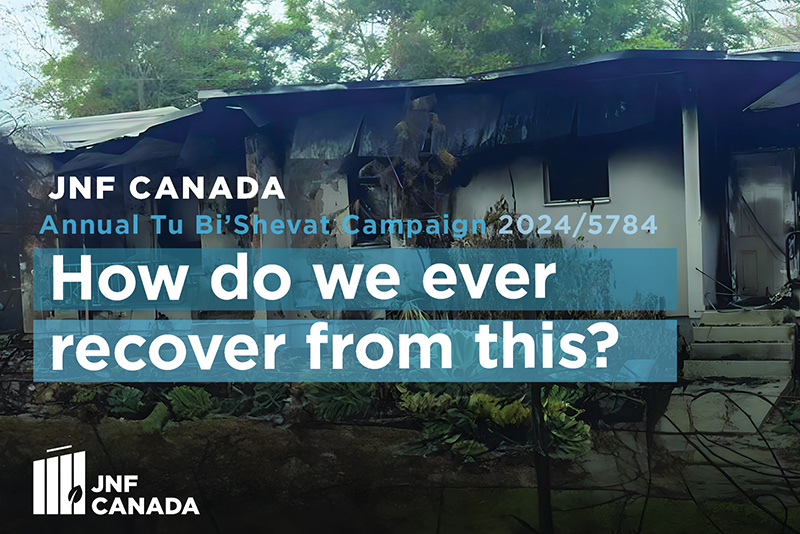

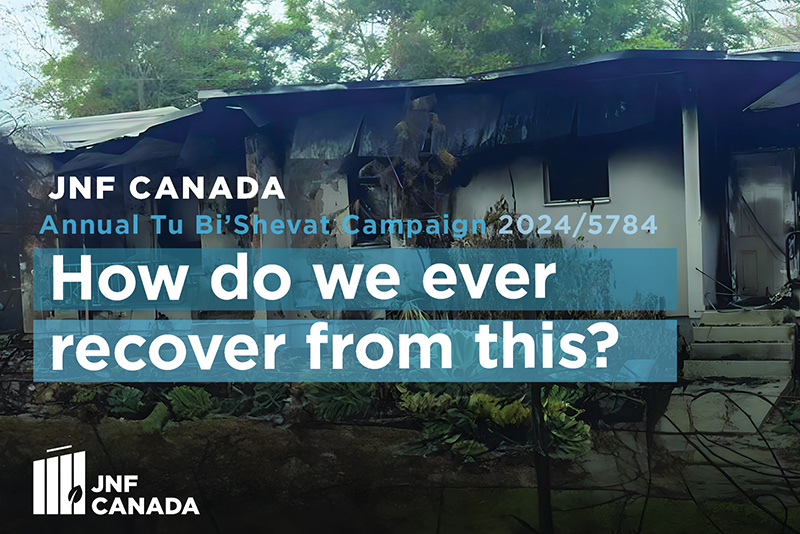

Campagne Tu Bi'Shevat 2024

Nous sommes sans mots pour décrire les mois qui viennent de s’écouler. Nous avons sélectionné deux projets spéciaux pour notre campagne annuelle de Tu Bi’Shevat, et nous espérons pouvoir compter sur vous pour montrer votre soutien à Israël, en particulier cette année.

Plus ici

Builders Circle

Vous cherchez un moyen de soutenir encore plus Israël ? Aidez-nous à construire et à reconstruire un Israël plus fort en finançant un projet qui a du sens pour vous. Nous avons plus de 100 projets dans différents domaines d'impact, y compris des projets de résilience après le 7 octobre. "Faites votre marque en Israël" aujourd'hui.

Plus iciPROJETS

ARBRES PLANTÉS

DONATEURS UNIQUES

VISION

FNJ Canada fait le lien entre la générosité de la communauté canadienne et les besoins en infrastructures de services environnementaux et sociaux d'Israël afin de construire les bases de l'avenir d'Israël.

À VENIR

À VENIR

FNJ Canada est un organisme de bienfaisance voué à enrichir la vie des citoyens israéliens. En reliant les donateurs canadiens à des projets d’infrastructures de services environnementaux et sociaux percutants en Israël, nous construisons Israël ensemble.

RÉCENT

RÉCENT

NOUVELLES | CRA

Email Update on Federal Court Ruling

NOUVELLES | CRA

Email Update on Federal Court Ruling

NOUVELLES | Général

NOUVELLES | Général